Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Income Tax Highlights of Budget 2025

CM admin

–

February 4, 2025

The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, introduced significant reforms in India’s income tax structure, aiming to provide relief to the middle class and stimulate economic growth. These changes are expected to enhance disposable income, thereby boosting consumption and savings among taxpayers.

Revised Income Tax Slabs

One of the most notable announcements is the increase in the basic income tax exemption limit under the new tax regime. Previously set at ₹7 lakh, the exemption threshold has now been raised to ₹12 lakh. For salaried individuals, the inclusion of a standard deduction of ₹75,000 effectively makes income up to ₹12.75 lakh tax-free. This move is anticipated to benefit a substantial segment of the middle-class population.

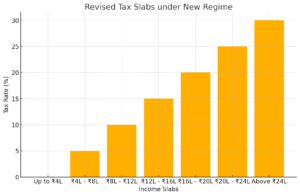

The revised tax slabs under the new regime are as follows:

- Income up to ₹4,00,000: No Tax

- ₹4,00,001 to ₹8,00,000: 5%

- ₹8,00,001 to ₹12,00,000: 10%

- ₹12,00,001 to ₹16,00,000: 15%

- ₹16,00,001 to ₹20,00,000: 20%

- ₹20,00,001 to ₹24,00,000: 25%

- Above ₹24,00,000: 30%

This restructuring introduces a more progressive tax system, with higher income brackets subjected to increased tax rates.

Enhanced Rebate under Section 87A

To further alleviate the tax burden, the government has increased the rebate under Section 87A from ₹25,000 to ₹60,000 for taxpayers with income up to ₹12 lakh under the new tax regime. This enhancement ensures that individuals within this income bracket have their tax liability effectively reduced to zero. However, it’s important to note that this rebate is not applicable to incomes taxed under special rates, such as capital gains.

Standard Deduction for Salaried Individuals

The standard deduction available to salaried individuals has been increased from ₹50,000 to ₹75,000 under the new tax regime. This adjustment not only simplifies the tax computation process but also provides additional relief to salaried taxpayers, further increasing their disposable income.

Rationalization of TDS and TCS

In a bid to simplify tax compliance, the budget proposes several changes to Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) provisions:

- TDS on Rent: The annual threshold for TDS on rent has been increased from ₹2.40 lakh to ₹6 lakh. This change is expected to reduce the compliance burden on individuals receiving rental income below this limit.

- TDS on Interest for Senior Citizens: The exemption limit for TDS on interest income for senior citizens has been doubled from ₹50,000 to ₹1 lakh, providing relief to senior citizens who rely on interest income for their sustenance.

- TCS on Foreign Remittances: The threshold for TCS on foreign remittances under the Liberalized Remittance Scheme (LRS) has been increased from ₹7 lakh to ₹10 lakh. Additionally, TCS will not be applicable to educational remittances funded by loans from specified financial institutions.

These measures aim to streamline tax processes and reduce the compliance burden on taxpayers.

Tax Exemption for National Savings Scheme Withdrawals

Recognizing the needs of senior and very senior citizens, the budget exempts withdrawals made from the National Savings Scheme (NSS) by individuals on or after August 29, 2024, from income tax. This move is expected to provide financial relief to individuals who have invested in NSS accounts.

Extension of Time-Limit to File Updated Tax Returns

The time frame for filing updated income tax returns has been extended from two years to four years from the end of the relevant assessment year. This extension offers taxpayers a greater window to rectify any omissions or errors in their Tax filings, promoting voluntary compliance.

Introduction of a New Income Tax Bill

In a significant move towards tax simplification, the government plans to introduce a new Income Tax Bill. This bill aims to streamline the tax regime, reduce the compliance burden, and make the tax system more taxpayer-friendly. The proposed legislation is expected to be tabled in Parliament in the week following the budget presentation.

Conclusion :

The Union Budget 2025-26 introduces comprehensive reforms in the income tax structure, with a clear focus on providing relief to the middle class and enhancing disposable income. By increasing the tax exemption limit, revising tax slabs, and enhancing rebates and deductions, the government aims to stimulate consumption and savings, thereby driving economic growth. Additionally, the rationalization of TDS and TCS provisions, tax exemptions for specific withdrawals, and the extension of timelines for filing updated returns reflect a commitment to simplifying tax compliance and promoting voluntary adherence. The proposed introduction of a new Income Tax Bill underscores the government’s intent to create a more streamlined and taxpayer-friendly tax regime. Collectively, these measures are poised to have a positive impact on taxpayers and the broader economy.

Contact Us to know more.

Have Any Question?

Do not hesitate to contact us. We’re a team of experts ready to talk to you.